Another “Econ 101” story we hear in microeconomics classes is that, as consumers, individuals are always involved in a rational, hedonistic competition trying to maximize their own utility. The utility principle was brought to the forefront of the economics profession with the Marginal Revolution of the 1870s. The Marginal Revolution, the story goes, was a response to the rise in prominence of the theories of Karl Marx. While this might be true, it is only part of the story. The rest has been conveniently left out of the intro courses because it reveals that the foundations of neoclassical economics were essentially plagiarized from the natural sciences.

Modern orthodox economists frequently theorize and propose their models wrapped in algebraic expressions and econometrics symbols that make their theories incomprehensible to anyone without a significant training in mathematics. These complicated mathematical models rely on sets of assumptions about human behavior, institutional frameworks, and the way society works as whole; i.e. theoretical underpinnings developed through history. Yet, more frequently than not, their assumptions go to such great lengths that the models turn out utterly detached from reality.

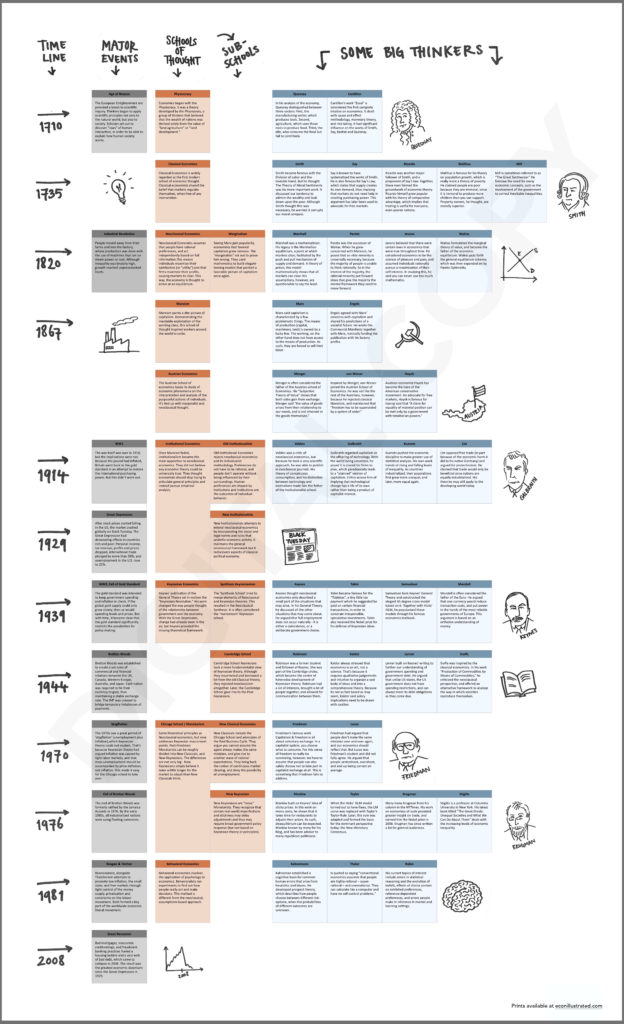

This approach was promoted during the 1870s, in an effort to emulate the success of the natural sciences in explaining the world around us, and so transform Political Economy into the “exact” science of Economics. The new discipline, born with a scientific aura, would provide a legitimate doctrine to rationalize the existing system and state of affairs as universal, natural, and harmonious. It is understandable that economists wanted their field to be more like the natural sciences. At the time, great advances in physics, biology, chemistry, and astronomy had unraveled many mysteries of the universe. Those discoveries had yielded rapid development around the world. The Second Industrial Revolution was well underway, causing a transition from rudimentary techniques of production to the extensive uses of machines. Physics and mathematics were validated to a great extent with the construction of large bridges, transcontinental railroads, and the telephone.There exists extensive evidence to establish that this success of the natural sciences and the scientific method had a big influence on the mathematization of what had been the field of Political Economy. Early neoclassical theorists misappropriated the mathematical formalism of physics, boldly copied their models, and mostly admitted so. Particularly guilty of this method were W.S. Jevons and Léon Walras; credited with having arrived at the principle of marginal utility independently.

Jevons’ Theory of Political Economy shows this very clearly. He explicitly says he wants to “treat Economy as a Calculus of Pleasure and Pain, the form which the science, as it seems to, must ultimately take.” Here Jevons has abandoned the term “Political Economy,” and instead he is talking about the science of “Economy;” a science that would become “as exact as many of the physical sciences; as exact, for instance, as Meteorology is likely to be for a very long time to come.” Moreover, the concern of this new exact science would be limited to “the mode of employing their [referring to the population] labour which will maximise [sic] the utility of the produce,” and taking as “given” institutions like the property of land.

Walras showed many of the same intentions, claiming that “pure theory of economics is a science which resembles the physic-mathematical sciences in every respect.” Walras wanted that the pure theory of economics would deal with the relation between men and things (what he called “industry”) in a scientific way, while relations among men (termed, “institutions”) would be the object of study of social economics employing non-scientific techniques. This way, Walras removed property rights and class conflicts from the set of issues with which economics should be concerned. He abstracted the pure Economics theory from reality, and created an imaginary, utopian world: “an ideal market . . . [with] ideal prices which stand in an exact relation to an ideal demand and supply.”

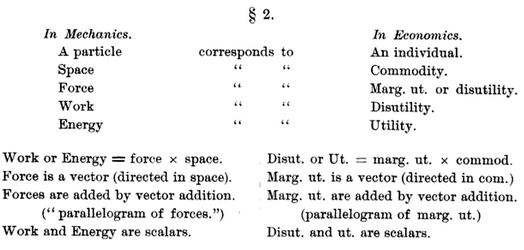

American economist Irving Fisher furthered the work of Jevons and Walras in even less subtle ways. By the end of the 19th century, Fisher was openly copying physics models, term by term and symbol by symbol! Fisher’s Mathematical Investigations shows how he takes physics concepts and translates them to economics jargon:

Figure 1. Correspondence between the terms taken from mechanics and their economics counterpart in Mathematical Investigations

Source: Fisher, I. Mathematical investigations in the theory of value and prices, and appreciation and interest (p. 85).

Of course, none of this would be problematic if the adapted physics theories could be applied as Jevons and Walras proposed. But humans are not particles! In order for their scientific approach to work, Jevons and Walras had to assume a utility theory of value, which implied that people’s individual preferences were perfectly quantifiable, and that the amount of pleasure they obtained from the consumption of a certain good could always be measured. With these tools, Jevons and Walras assumed people to make rational decisions with the intention to maximize their utility.

This way, the Marginal Revolution transformed Political Economy into the pure science of Economics. Their methods, however, reveal that this formalization was more of a scam than an actual process of discoveries through scientific methods. Those who followed, however, took it to be a solid foundation. The founders of neoclassical economics used it to build theories that portray the existing order as rational, natural, and just. The social setting of the individual, institutions, and social relations of production continued to be exempt from examination, in the name of impartiality and objectivity. Economic “laws” continued to be devised—not discovered. The economy came to be portrayed as a system that operates autonomously and independently of human will, and comes to harmonious fruition under a free-market capitalist system of production. These conclusions, however, are built into the assumptions.

The urgency with which these theories were invented can be understood against the backdrop of Marx’s rise in popularity. Marx explained capitalism in the way a mechanic would open the hood of a car and explain the function of each part. His theories talked of conflicts of classes and exploitation as the inevitable consequence of private property, and the reduction of labor to another factor of production. With the intention to develop a counterargument, neoclassical thinkers decided to exempt those exact elements from their examination, and their models would show a capitalist society where there exists no exploitation, but rather a harmony of interests among classes and where the income created is divided according to the marginal productivity of each factor of production. No wonder neoclassical economists, like Robert Lucas, consider issues of distribution as “harmful” and “poisonous” to the economics profession; even in the face of staggering inequality. Maybe Piero Sraffa was right when he suggested that we should toss out these faulty theories.

Written by Oscar Valdes-Viera

Illustration by Heske van Doornen