Every so often, we highlight one of the senior scholars that has supported the Young Scholars Initiative as a mentor. We share their perspective on the discipline, their past experiences as a young scholar and their thoughts on New Economic Thinking. This time, we talk to Gonçalo Fonseca, Research Fellow at INET and creator of the ever-expanding History of Economic Thought Website. His research is on the intersection of the history of economic thought and economic theory.

Were you always interested in economics, even at a young age?

Not really; I did read a lot as a kid, but not necessarily economics. I grew up in Zambia, where people hardly had anything. But then at 18, I moved to New York, to attend the New School. I actually started off as an Africanist, doing African studies; mostly politics, history. There actually wasn’t much economics offered at the undergraduate level, but one way or another, African studies inevitably leads to questions of development. So when Gunseli Berik allowed me to sit in on her graduate-level economic development class, it blew my mind; she opened the door, and from then on, I was in. I delved deeper into economics, Alice Amsden and Tom Palley being perhaps the strongest influences among many great professors I have had. I continued my graduate studies at Johns Hopkins, studying under M. Ali Khan, then returned to the New School to finish my Ph.D. with Duncan Foley.

Was it tough being a young scholar?

In the early days, I did experience a lot of the same challenges that young scholars today express; economics is a restrictive discipline, and I felt that too. Young people tend to be very anxious, particularly about choices that might affect their careers. They tend to see their futures too narrowly, thinking that there is only one path, or that they have to do things one way, or everything will go wrong. But I managed to do my own thing. I ended up giving myself a lot of leeway; perhaps more so than other people. I let myself chase shiny objects; I let myself pursue my interests. Partly because nobody told me what the path was, or was supposed to be! So I just did what made sense to me. I allowed myself to get immersed in things. And I developed myself broadly by combining my New School education, where the teaching was more unconventional, with my training at Johns Hopkins.

What is your advice to young scholars?

Chase the shiny objects! By which I mean pursue things that really interest you, or that really irritate you, that you’re really furious about, or dissatisfied with. Really pursue them, so that they can become yours. As strange as it sounds, if you can find one small thing that’s really yours, you will always be the reference for it. Don’t be the nth person working on a generic problem. Be the point person working on the thing that really interests you, and become the expert in that. Economics may seem unforgiving, but it’s not. There is leeway! Even in conventional departments. It’s valued when someone is really knowledgeable about something that they care about. It takes a little courage to get there. But it’s worthwhile.

My experience with students is that they are very curious and engaged with the world. And it takes years to beat that out of them. So the key is to retain that curiosity and to follow it. Don’t let publications be the only metric that matters to you. Don’t make the publication the goal. Make the goal that you contribute to the field.

But don’t get mistaken. It’s chasing shiny objects, and it’s fun, but it’s hard work. I’m really trying to understand something. What people are trying to say. How they fit with others. All that is work; lots of not sleeping, and pain. It’s like building anything else.

A lot of it is going to corners you didn’t expect to. Topics you didn’t think you were interested in. Stuff you didn’t imagine you cared about. Realizing hold on, there’s something here. And poking at it, and then getting lost, overwhelmed, start bringing your own narrative on it; you make it yours. And there’s really something to learn from everyone.

As a general strategy, in order to understand something, you have to be able to explain in plain English. To reach that, you really have to go deep and try to get a perspective and understand how it fits in its context. It’s work, but it’s very pleasurable. Once you get a grip on it, you get the “ah..” But before that, you may be frustrated. I’ve made myself learn obscure math just to be able to understand something, in order to understand something related to that. And once you have it, you’ve made it yours. It’s an armament.

Your point touches on the importance of being able to explain something to others, on teaching!

Yes, I’ve been teaching economics as long as I’ve been learning economics. Once you’re teaching something, you can start to really understand it. Already in undergrad, we’d organize with classmates to teach each other. Then we TA’d, and taught entire courses. At that point, it is harder to cut corners. You can, but you’re not doing yourself any favors. Especially once you start teaching people who don’t have a background in the subject, it forces you to think about it systematically. And the more you work on that, the more it becomes yours. This is why teaching is vital.

And it doesn’t even matter what the topic is. I have taught everything from econometrics to philosophy, and every time, I am happy, because I get to learn something; there’s something to learn from everything.

Who is the best teacher you’ve ever had?

Ali Khan, at Johns Hopkins. He taught mathematical economics, which is something people can easily get lost in. And he was very systematic. So I took a lot of tips from how he teaches. And what I always keep in mind is that my students are not there for me; I’m there for them. A lot of them have made sacrifices to be able to study, and they deserve the best. You can make a big difference if you manage to inspire those who are taking their first economics course. Even if they do not end up being economists, their understanding of the economy, civically, is very important. Similarly, I love being a mentor to young scholars in YSI.

How did the History of Economic Thought Website come to be?

It was actually a favor…! Heilbroner was teaching a course at the New School, while I was at Johns Hopkins. He was assigning a lot of reading, much of which was actually available online; it was just that nobody had put anything together. These were the early days of the web.. 1997. So one of his students, who was a friend of mine, asked me if I could gather these readings in one place online. She knew nothing about coding and I didn’t either. But she asked me if I could figure it out, and I did! And then it grew. From excitement, and because once you’ve covered this person, you know you should also cover that person, and then you just keep going. It became a lot bigger than I thought.

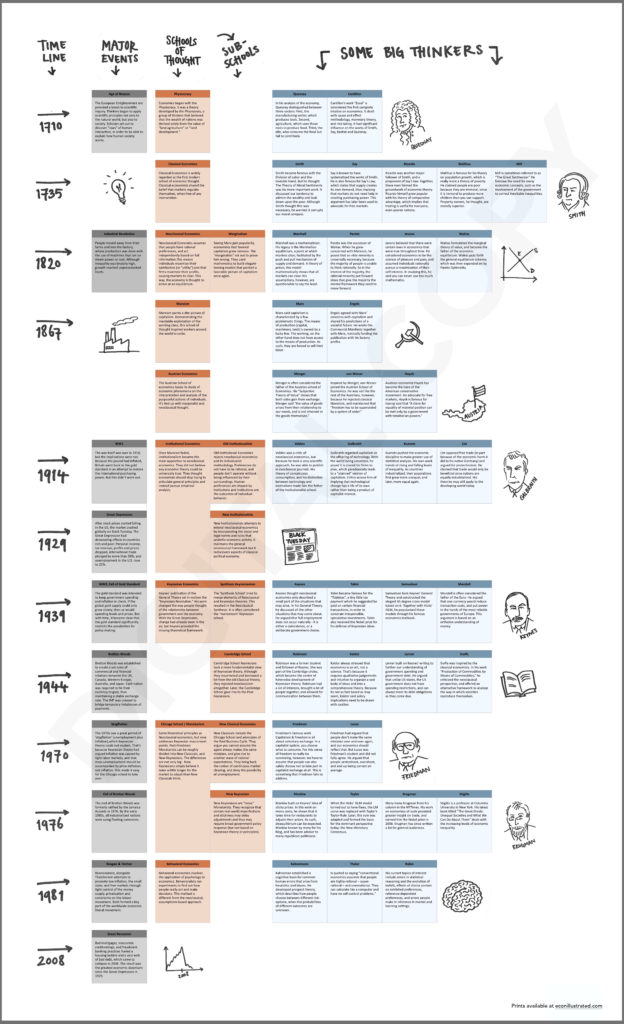

It was pre-Wikipedia, so it was a new thing to let one piece link to another and then another. Which is fantastic, because it means things don’t have to be linear like a book. The purpose is for it to be non-linear, so that you can roam, see what thoughts connect with what theories, what mentors connect with what students, what approaches there are between various groups.

What makes the History of Economic Thought such a powerful field, for you?

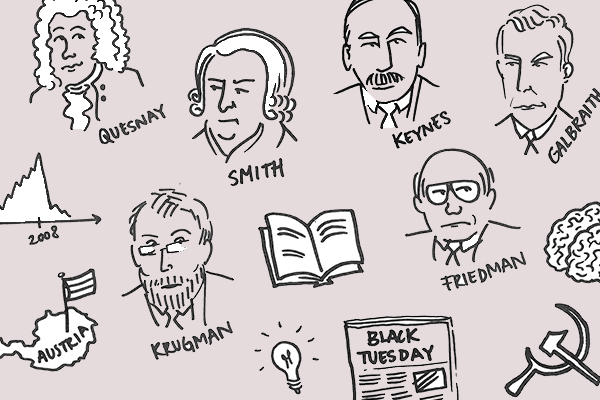

Many reasons. For one, it’s beautiful. But more importantly, it really helps you understand the theory. It can help you understand why a theory developed one way or another. It can allow you to see things more clearly, and help you understand the reasons why it’s structured the way that is. Because economics is not leveled or settled. And it’s not just models! At the end of the day, economics is constructed by people. It’s driven by people, and the questions they have. Their interests, the relationships they have, whether those are relationships of mentorship or rivalry.

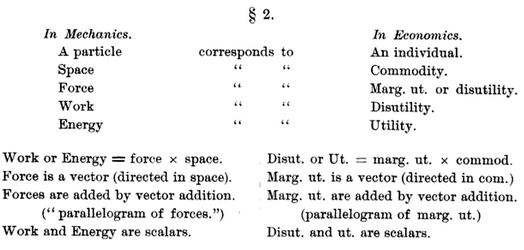

Sometimes, the math in economics obscures this. But math in economics is like the notes on the page for music. Music is what you hear from a violin. The notes on the page are not the music. So some people condemn mathematics. And they shouldn’t. You can’t get mad at the mathematics in economics, just like you can’t be mad at sheet music. You can only be mad at whether the tune sounds good or not. By studying the History of Economic Thought, you get to see the full picture. You hear the full tune; and then you can decide for yourself.

Take a look at Gonçalo’s History of Economic Thought website! If there is another new economic thinker that you’d like to see featured here, let us know! Share your thoughts in the comments below, or email us at contact@economicquestions.org