By Nikos Bourtzis.

Much of the developed world has experienced stubbornly low real wage growth since the financial crisis of 2007. Currently, the British people are seeing their earnings decline in real terms. Even in Germany, where unemployment keeps falling to record lows, wage growth is stagnating. This phenomenon has squeezed living standards and has been one of the main culprits behind the rise of anti-establishment movements. Faster pay rises are desperately needed for the global recovery to accelerate and for ordinary people to actually be a part of it. This piece explains why rising labor compensation has been relatively minuscule during the current economic upturn and how this phenomenon could be remedied.

A bit of history

The lack of meaningful pay rises is not a phenomenon that started with the financial crisis of 2007. It can be traced back to the 1970s and 1980s, when monetarism started sweeping into academia and politics. The stagflation of the 1970s, the simultaneous rise of inflation and unemployment, led some governments to abandon the Keynesian policies of the past because apparently these policies could not deal with the stagflation. Monetary policy became the preferred tool to control inflation, together with a revived notion that markets, if left to their own devices, would bring the best social outcomes. The Thatcher and Reagan governments are some of the most famous examples of States adopting and implementing these beliefs. The first institution targeted for deregulation was the labor market. Wages increases were frozen and employment protection was scaled back, because it was believed that demand and supply forces would restore full employment. However, unemployment in the UK exploded after Thatcher came into office in 1980, increasing to over 10% and never returning to its post-World War II lows of between 1% and 2%.

Labor unions are one of the most important institutions regarding pay rises. In most industrial countries, they are responsible for wage and working conditions negotiations between employers and employees. Union membership in OECD countries grew until the mid-1970s but then started dropping. With the rise of neoliberal governments in the West, organized labor came under attack. Under the free-market ideology, unions disrupt economic activity with strikes and demand higher-than-optimal wages. Thus, their power needed to be kept in check. What is more important, though, is the shifting of ideas in what the goals of the State should be. In the post-War period, an expressed purpose of governments was to keep aggregate demand at full employment levels. The UK government, for example, stated full employment as its purpose after the War in its Economic Policy White Paper in 1944. That goal changed with the rise of neoliberalism.

When the commitment to keep employment levels high and stable was abandoned, and labor markets were deregulated, unemployment spiked in most countries and has never fallen at levels where it can be stated that full employment exists. Even during strong upturns unemployment levels in most countries did not dip below 4%. As a result, labor unions, and workers in general have lost their biggest bargaining chip. When there is full employment, and thus jobs are abundant, workers have more power to demand higher wages and better working conditions. With the neoliberal policies of the Reagan administration, real wages in the US got decoupled from productivity, meaning that workers stopped receiving their fair share of the output produced. The same phenomenon has been observed in many other industrialized countries, such as the UK. The policies introduced in the 1980s were pretty much sustained and expanded up until 2008.

The Financial Crisis: A turn for the worse

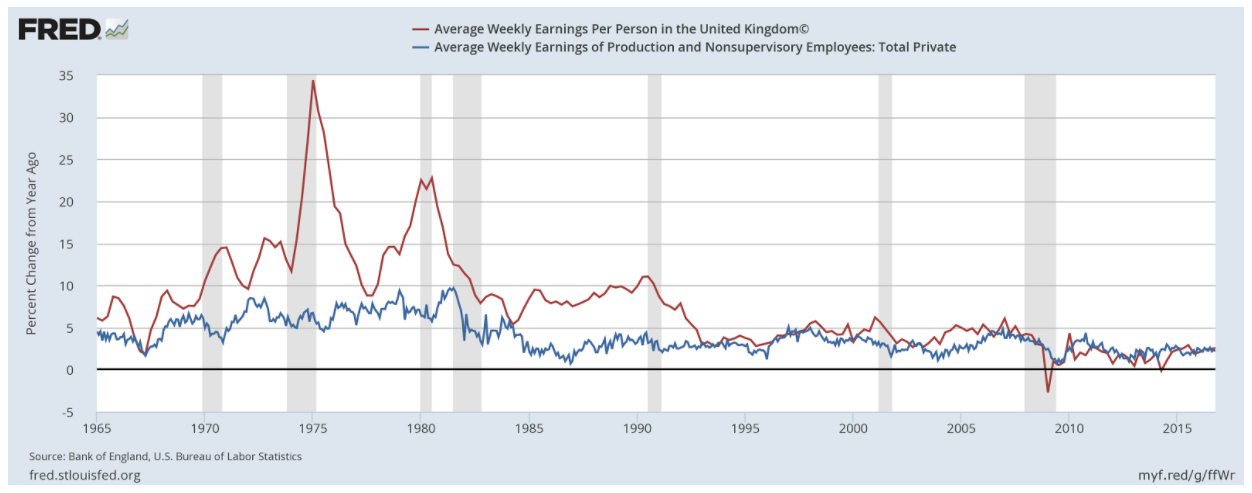

The situation became even worse after the financial crisis erupted. For example, in both the US and the UK the growth of wages slowed even more, as shown in the following figure, even as the headline unemployment returned to pre-crisis levels.

Moving towards a low headline unemployment rate, though, does not mean full employment is being achieved. In the US, the U-6 measure of the unemployment rate, which adds the underemployed to the headline rate, shows that the real unemployment rate is at 8.6%. Far from full employment! In the UK, it has been reported by the Office for National Statistics that the number of people employed in zero-hour contracts has risen by 400% since 2000 but most of the rise happened after the financial crisis. Thus, the employment situation is worse than before the crisis which leads to a further decline in wage growth.

Why is high wage growth important for the recovery?

It is essential to point out that one of the main reasons the current economic recovery has been weak is low wage growth. Wage income is the main propeller of consumer spending, which accounts for more than 60% of GDP in industrialized countries. Low wage growth means low consumer spending, thus low GDP growth and employment. Currently, households are borrowing to keep their living standards stable and that is what’s keeping consumer spending going. This process, though, is unsustainable and will not last long. When households cannot afford to borrow anymore another financial crisis will almost certainly occur. That’s why governments need to do everything in their power to restore wage growth.

What can be done?

The power of organized labor has been decimated since the 1980s. If workers cannot actually have a say in what happens in the workplace then they cannot fight for fair wages. This is why unions need to be strengthened and supported by governments. Employers should be forced to negotiate wages through collective bargaining and union coverage should be expanded above the current 50% OECD average. This will level the playing field between powerful employers and the currently weak labor class.

As mentioned before, productivity and real wages have been delinked since the 1980s. That’s where the minimum wage could potentially help. In the US, the real minimum wage fell after 1980 and has stayed relatively flat since then. With the liberalization “mania” sweeping the western world, governments are freezing public sector pay rises and Greece even cut the minimum wage in the name of restoring public finances and growth. That’s the exact opposite of what should be done to restore growth. Wages drive consumption and growth, cutting them can only depress the economy. Hiking the minimum wage will help sustain consumption based on wages, employment growth and, thus, wage growth.

A sure way to speed up wage growth again is fiscal stimulus. Government spending lifts aggregate demand directly and effectively. If enough spending is injected into the economy, it will create enough jobs to bring full employment. The momentum and labor scarcity created by the stimulus will force wages up and give workers and labor unions more bargaining power. A Job Guarantee Program, if ever implemented, would effectively set a wage floor in the economy, since any person working at a lower wage than the Job Guarantee offers will be given work in the public sector.

The “curse” of low wage growth is not something new and it definitely got exacerbated with the financial crisis. Even though unemployment is currently falling in many countries, it is still way above full employment levels. With workers’ rights under attack for some time now, unions do not have the power they once did to promote strong pay growth. If the current recovery is to accelerate, and for ordinary people to participate in it, wage growth has to rise substantially. The only way to do this is for labor unions to be strengthened and governments to once again commit to full employment.

About the Author

Nikos Bourtzis is from Greece and recently graduated with a Bachelor in Economics from Tilburg University in the Netherlands. He will be pursuing a Master in Economics and Economic analysis at Groningen University. Research interests are heterodox macroeconomics, anti-cyclical policies, income inequality, and financial instability.

Why not set the income tax rate to zero?

I was told that in Germany and some other countries that a certain percentage of the board of directors has to be laborers. This might be a partial solution to eroding pay.

I think this is a great idea because it ensures some feed back from the most crucial part of the company. And it partially protects labor the most crucial part of the company. It also probably makes some of labor learn accounting which is valuable.

Tuan,

If income tax is 0 and there are government expenses the the amount will come from some where else. Some where else might be service and licensing fees, asset taxes, asset appropriation or appropriation of goods and services by printing money.

The problem with the money printing is it lowers every one’s real pay!

Is there any information on the effect of lower wages and reduced purchasing power on consumption, savings and on residential standards. It would appear that because wages have been cut and profits on production raised that the economy (particularly the producers) has benefited. Yet this cannot be possible when the amount being spent on consumables and on residences etc has decreased.

Chester you make a good point about consumption!

On the producer side though, real profits can be reduced or turned negative due to the dilution of currencies.

One of the big reasons is that the productive capital has to be replaced at a higher price, to stay in business. So, if the accounting deprecation expense is not increased the accounting profit is looks higher than it actually is. And, come time to renew aging equipment it could be 2-10 times the original costs but the products sales price might not have been raised to account for the higher price of productive capital. At least one needs to adjust depreciation expenses for loss of purchasing power of the currency.

An excellent explanation is given by Warren Buffett in one of the Birkshire Hatheway letters of the 1970s I believe. The quote below is not an explanation but a statement of the problem.

” Explicit income taxes alone, unaccompanied by any implicit

inflation tax, never can turn a positive corporate return into a

negative owner return. (Even if there were 90% personal income

tax rates on both dividends and capital gains, some real income

would be left for the owner at a zero inflation rate.) But the

inflation tax is not limited by reported income. Inflation rates

not far from those recently experienced can turn the level of

positive returns achieved by a majority of corporations into

negative returns for all owners, including those not required to

pay explicit taxes.”

I like alot of what you have highlighted here. But I always question why always monetary when work is measured in available hours. Why not modify the requirements for full-time hours to between 30-32 hours a week at which over-time kicks in for all labour forces. Restrict an employers ability to not reduce individual income below the 75% of present income since the individual is still working 3/4 of their present employment. This would force employers to evaluate new mechanisms for automation or hire new employees (employers may even opt to leave the existing work forces wages intact to avoid having to compete with the open market to fill all the NEW roles that will open as a result of reduced labour hours). Thoughts?

Sounds like Europe especially France and Italy. The French economists must be smarter and better than ours.

I think your suggestion is a great solution instead of doing layoffs. It seems much better for society and for the company to not loose their employees knowledge.

Please do not use the phrase ‘real unemployment rate’. There is no ‘real’ rate. There are several different ways of measuring unemployment, and no one is particularly more valid than any other.

I have liked using employment population ratio. Employed/Population.

But, with any ration one needs to look at both variables individually also.

Since the stagflation of the 1970s labor share of GDP in the US and other parts have been falling. In 1971 the US went full fiat currency, and the purchasing power has dropped over a long time.

I have been studying hedging for this continuous event of loss of purchasing power of currencies. In that study it becomes obvious that real wages drop exponentially with the continuous exponential dilution of currency unless wages are repeatedly renegotiated. And, that is what the data seems to show from approximately 1970 in the US.

Loss of purchasing power of currency since the 1970s lowers real pay unless it is repeatedly renegotiated. by every one.

One day a friend asked why he felt like he was not ahead or felt behind with about a 10% raise. I knew it was inflation and taxes and taxes on that inflation. But, I wanted to quantify it for both of us.

So, I went home and made a spread sheet. I looked up the state and federal tax brackets, FICA, and of course the sales tax for some ratio of spending to support one self. Stuck them in the spreadsheet. But I already knew our increase in earnings was taxed at the marginal highest rate because they are the last dollars earned, then you loose on inflation on the whole of what is left. That can’t be good.

It goes like this… What did you make before a year ago after taxes? And, what do you make a year later with the raise after taxes and purchasing power loss for the year? What is the difference or percent change? It turned out one fell behind. You can also graph this for different inflation rates and raises.

On top of that, all your stuff that depreciates will need replacing at a higher cost. I did not think about that then as I was ignorant of accounting and inflation accounting when the unit of account becomes a rubber ruler.

I think that this wage falling behind is a main reason for inequality of incomes in the developing world where there has been high rates of loss of purchasing power of the currency. The currency purchasing power losses of course have other causes.

Dear Nikos Bourtzis,

I wanted to write you a comment and suggest that, if you have not already done so, you would be well served to learn double entry bookkeeping or accounting. And, that you are in a country that has played a historical part in disseminating it from Venice, Italy, and has played a big part in its history as an entropote. Double entry is probably part of the culture. Thus you are in a great environment for people to help you learn it! (Venice probably picked it up in trade with the Indians along with the base 10 decimal and fraction system, to replace Roman numerals.) People in the Netherlands can explain it to you and make the learning curve much easier.

Any how, I saw the University you are going to at the end of your article. I learned bookkeeping after reading a paper of Professer Bezemer from U. of Gronigen. I actually put all econ. aside to learn accounting to better understand hetrodox economics. I had given up on equilibrium etc. I am so glad I did and found it to be very a valuable tool outside of econ. too.

‘No one saw this coming’ – or did they?

by Dirk Bezemer

Assistant Professor in the Department of International Economics and Business, University of Groningen

http://voxeu.org/article/no-one-saw-coming-or-did-they

Here is some history on bookkeeping. The first two books could make it simpler to learn if you don’t have some one to ask, but you do! The fist one is written by some on from your new part of the world about the history it has played.

“Ancient double-entry bookkeeping : Lucas Pacioli’s treatise (A.D. 1494 – the earliest known writer on bookkeeping)” , 1914

by Geijsbeek, John B. (John Bart), 1872-; Manzoni, Domenico, 16th cent; Mainardi, Matteo, 17th cent; Christoffels, Jan Ympyn, 16th cent; Stevin, Simon, 1548-1620; Dafforne, Richard; Pacioli, Luca, ca. 1445-1517; Pietra, Angelo, 16th cent

There are many copies on line, google. I have seen on in a library too, it is nicer in paper as it is large format.

The discursion in theory section starting on p. 14 is good for learning double entry.

https://archive.org/details/ancientdoubleent00geijuoft Is one copy on line.

The book above is actually better than this one. But is still good.

“Double Entry: How the Merchants of Venice Shaped the Modern World”, 2011, by Jane Gleeson-White.

https://www.goodreads.com/book/show/13136518-double-entry

https://bookishgirl.com.au/double-entry/

This is on the Indian History. (India used to be responsible for 25% of the worlds GDP in ancient times.)[1]

“Bahi-Khata: The Pre-Pacioli Indian Double-entry System of Bookkeeping”

B.M. Lall Nigam, ABACUS, September 1986F

http://onlinelibrary.wiley.com/doi/10.1111/j.1467-6281.1986.tb00132.x/abstract

Any how, some one gave me a simpler explanation than I have seen in accounting books; debiting an account means value goes into that account and crediting an account means value comes from that account. And, since nothing gets lost and all is accounted for the ins equal the outs, thus the debits equal the credits.

1. https://en.wikipedia.org/wiki/Economic_history_of_India#/media/File:1_AD_to_2003_AD_Historical_Trends_in_global_distribution_of_GDP_China_India_Western_Europe_USA_Middle_East.png

“Understanding financial crisis through accounting models”

Dirk J.Bezemer, University of Groningen, Faculty of Economics, The Netherlands”

http://scholar.google.com/scholar?q=UNDERstanding+the+financial+crisis+through+accounting+models&hl=es&as_sdt=0&as_vis=1&oi=scholart

The pdf link in google scholar loads the paper with out having to sign up.

Correction: The simple explanation I was given I have not seen in accounting books.