Another “Econ 101” story we hear in microeconomics classes is that, as consumers, individuals are always involved in a rational, hedonistic competition trying to maximize their own utility. The utility principle was brought to the forefront of the economics profession with the Marginal Revolution of the 1870s. The Marginal Revolution, the story goes, was a response to the rise in prominence of the theories of Karl Marx. While this might be true, it is only part of the story. The rest has been conveniently left out of the intro courses because it reveals that the foundations of neoclassical economics were essentially plagiarized from the natural sciences.

Modern orthodox economists frequently theorize and propose their models wrapped in algebraic expressions and econometrics symbols that make their theories incomprehensible to anyone without a significant training in mathematics. These complicated mathematical models rely on sets of assumptions about human behavior, institutional frameworks, and the way society works as whole; i.e. theoretical underpinnings developed through history. Yet, more frequently than not, their assumptions go to such great lengths that the models turn out utterly detached from reality.

This approach was promoted during the 1870s, in an effort to emulate the success of the natural sciences in explaining the world around us, and so transform Political Economy into the “exact” science of Economics. The new discipline, born with a scientific aura, would provide a legitimate doctrine to rationalize the existing system and state of affairs as universal, natural, and harmonious. It is understandable that economists wanted their field to be more like the natural sciences. At the time, great advances in physics, biology, chemistry, and astronomy had unraveled many mysteries of the universe. Those discoveries had yielded rapid development around the world. The Second Industrial Revolution was well underway, causing a transition from rudimentary techniques of production to the extensive uses of machines. Physics and mathematics were validated to a great extent with the construction of large bridges, transcontinental railroads, and the telephone.There exists extensive evidence to establish that this success of the natural sciences and the scientific method had a big influence on the mathematization of what had been the field of Political Economy. Early neoclassical theorists misappropriated the mathematical formalism of physics, boldly copied their models, and mostly admitted so. Particularly guilty of this method were W.S. Jevons and Léon Walras; credited with having arrived at the principle of marginal utility independently.

Jevons’ Theory of Political Economy shows this very clearly. He explicitly says he wants to “treat Economy as a Calculus of Pleasure and Pain, the form which the science, as it seems to, must ultimately take.” Here Jevons has abandoned the term “Political Economy,” and instead he is talking about the science of “Economy;” a science that would become “as exact as many of the physical sciences; as exact, for instance, as Meteorology is likely to be for a very long time to come.” Moreover, the concern of this new exact science would be limited to “the mode of employing their [referring to the population] labour which will maximise [sic] the utility of the produce,” and taking as “given” institutions like the property of land.

Walras showed many of the same intentions, claiming that “pure theory of economics is a science which resembles the physic-mathematical sciences in every respect.” Walras wanted that the pure theory of economics would deal with the relation between men and things (what he called “industry”) in a scientific way, while relations among men (termed, “institutions”) would be the object of study of social economics employing non-scientific techniques. This way, Walras removed property rights and class conflicts from the set of issues with which economics should be concerned. He abstracted the pure Economics theory from reality, and created an imaginary, utopian world: “an ideal market . . . [with] ideal prices which stand in an exact relation to an ideal demand and supply.”

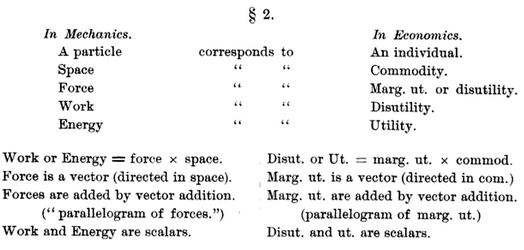

American economist Irving Fisher furthered the work of Jevons and Walras in even less subtle ways. By the end of the 19th century, Fisher was openly copying physics models, term by term and symbol by symbol! Fisher’s Mathematical Investigations shows how he takes physics concepts and translates them to economics jargon:

Figure 1. Correspondence between the terms taken from mechanics and their economics counterpart in Mathematical Investigations

Source: Fisher, I. Mathematical investigations in the theory of value and prices, and appreciation and interest (p. 85).

Of course, none of this would be problematic if the adapted physics theories could be applied as Jevons and Walras proposed. But humans are not particles! In order for their scientific approach to work, Jevons and Walras had to assume a utility theory of value, which implied that people’s individual preferences were perfectly quantifiable, and that the amount of pleasure they obtained from the consumption of a certain good could always be measured. With these tools, Jevons and Walras assumed people to make rational decisions with the intention to maximize their utility.

This way, the Marginal Revolution transformed Political Economy into the pure science of Economics. Their methods, however, reveal that this formalization was more of a scam than an actual process of discoveries through scientific methods. Those who followed, however, took it to be a solid foundation. The founders of neoclassical economics used it to build theories that portray the existing order as rational, natural, and just. The social setting of the individual, institutions, and social relations of production continued to be exempt from examination, in the name of impartiality and objectivity. Economic “laws” continued to be devised—not discovered. The economy came to be portrayed as a system that operates autonomously and independently of human will, and comes to harmonious fruition under a free-market capitalist system of production. These conclusions, however, are built into the assumptions.

The urgency with which these theories were invented can be understood against the backdrop of Marx’s rise in popularity. Marx explained capitalism in the way a mechanic would open the hood of a car and explain the function of each part. His theories talked of conflicts of classes and exploitation as the inevitable consequence of private property, and the reduction of labor to another factor of production. With the intention to develop a counterargument, neoclassical thinkers decided to exempt those exact elements from their examination, and their models would show a capitalist society where there exists no exploitation, but rather a harmony of interests among classes and where the income created is divided according to the marginal productivity of each factor of production. No wonder neoclassical economists, like Robert Lucas, consider issues of distribution as “harmful” and “poisonous” to the economics profession; even in the face of staggering inequality. Maybe Piero Sraffa was right when he suggested that we should toss out these faulty theories.

Written by Oscar Valdes-Viera

Illustration by Heske van Doornen

Good summary. I’d like to recommend also John Bates Clark’s The Distribution of Wealth: A Theory of Wages, Interest and Profits (published originally in 1899, but you can find the link to the 1908 edition below.

Clark explains his motivations in chapter 1:

“The welfare of the laboring classes depends on whether they get much or little; but their attitude toward other classes-and, therefore, the stability of the social state-depends chiefly on the question, whether the amount that they get, be it large or small, is what they produce. If they create a small amount of wealth and get the whole of it, they may not seek to revolutionize society; but if it were to appear that they produce an ample amount and get only a part of it, many of them would become revolutionists, and all would have the right to do so. The indictment that hangs over society is that of ‘exploiting labor.’ ‘Workmen’ it is said, ‘are regularly robbed of what they produce. This is done within the forms of law, and by the natural working of competition.’ If this charge were proved, every right-minded man should become a socialist; and his zeal in transforming the industrial system would then measure and express his sense of justice.”.

http://www.econlib.org/library/Clark/clkDW1.html

Knut Wicksell is another author you might want to consider.

I beg to differ on many of these matters. The contribution of John Bates Clark was to make capitalism inclusive of landlordism. These two entities act in very different ways and the deliberate attempt to combine them hides the way that the speculators in land values are different than the stock market is exploited. Land values rise as the place is developed and the taxpayers help the municipality to invest in the infrastructure, which causes the land to become more valuable. Thus landlords can get a free lunch when they with the banks speculate in this natural resource. Bates chose to hide this effect which Henry George in 1879 exposed in his seminal book “Progress and Poverty” Due to the greed o0f landlords, our present economics system is being shattered and the opportunities to work on useful land are being delayed. Entrepreneurs cannot afford the high prices of access rights to land.

The above quotation suggests that Clark was opposed to the workman of his day and Clark sought to show how little his work is needed or appreciated.

The trouble with applying mathematical modeling to macroeconomics is that unless you include the whole of the social system, the bit that is missed out will spoil the whole thing. This subject has never been treated as a properly dynamic system in the physical way it really is. So it is not surprising so many are opposed. However tyere is a way out and that is to include the whole shebang, see my SSRN 2865571 modeling method.

I am afraid it is I who begs to differ, now.

Georgism and second generation marginalists (like John Bates Clark) were equally opposed to Marxism. If the notorious and well-known mutual hostility between Marx and George were not enough to prove this, Prof. Mason Gaffney, the prominent Georgist, has written about it:

“George Bernard Shaw, another George fan, also engaged Wicksteed to instruct him in the basic Ricardian economics he needed to extricate Fabianism from Marxist theoreticians. Shaw found these too mystical and cryptic. Wicksteed’s and Shaw’s common interest in George helped to bring them together, and deeply affected the Fabian Society, which continued to support George after Hyndman and his Social Democrats turned against him. After being tutored by Wicksteed, Shaw attacked the Marxist Hyndman caustically, as Wicksteed never would, but GBS himself could (Shaw, 1889).”

(Neo-classical Economics as a Stratagem against Henry George, p. 63)

In other words, Wicksteed would have had no reason to object to Clark’s quote above. Neither would he have had any reason to complain about marginal productivity of labour/capital (later in the book, Gaffney suggests that indeed Clark may have had “borrowed” these notions from the Georgist Wicksteed).

His and George’s objection to Clark’s work, and in this I concur with the previous commentator, is that Clark did consider land as a component of capital, while Wicksteed did not.

If one accepts Wicksteed’s and Clark’s anti-Marxist stances, one then is forced to ask oneself: who is right? Clark or Wicksteed?

Clark had a good reason to consider land as part of capital: capital is a physical asset, so is land. That’s how capitalists regard land and that’s how land is considered, for instance, for accounting purposes. Furthermore, that’s the traditionally accepted definition of capital (from the Penguin Dictionary of Economics):

“Capital. 1 Assets which are capable of generating income and which have themselves been produced. Capital is one of the four FACTORS OF PRODUCTION, and consists of the machines, plant and buildings that make production possible, but excludes raw materials, LAND and LABOUR. (…)

“2. In more general usage, any asset or stock of assets – financial or physical – capable of generating income.”

Against that, I find it difficult to defend the land vs capital differentiation crucial to Georgists.

@Magpie

A legal & fiscal distinction between man-made things & non-man-made things (natural monopolies) has to be made. Michael Hudson explains this stuff in under 4 minutes. In my opinion, a capital mistake in marxist PR was flat out collectivization. If they had insisted in nationalizing only natural monopolies, whilst leaving man-made things in private ownership, people (high and low) would have been less reticent about it.

Forgot the link to Hudson https://www.youtube.com/watch?v=Elg6i3NxvdE

What is “PR”? (as in “marxist PR”)

At any event, one thing is people’s reticence to a political position, another thing is the political position being wrong. Is it worth sacrificing principle in the altar of political expediency?

Take Keynesian policies as an example. People are reticent to accept debt increases, government budget deficits and regulation. It is expedient to oppose those things. Should one, then, oppose Keynesian policies?

Yes, I was referring to PR as in public relations. I disagree that collectivization was the solution in the 20th century. If you’re not interested that one’s stance is political harakiri in the eyes of the public, then that’s your choice. Debt-increases (aka deficit spending) is NOT the same as arguing in favor of collectivization. Just like a reduction in fiscal drag is not the same as privatizing public assets.

Perhaps a commercial metaphor would help here.

I am ready to sell only the product I believe in. If it doesn’t sell, well, what can I do? It’s a matter of principle. I won’t peddle what I don’t believe in just out of expediency.

If that’s political harakiri, well, so be it.

I suppose anti-Marxist don’t agree. Fair enough. That’s their choice.

To complement my comment above.

Commenting on Donald R. Stabile’s Henry George’s Influence on John Bates Clark [The American Journal of Economics and Sociology

Vol. 54, No. 3 (Jul., 1995), pp. 373-382)], Prof. Gaffney writes (p. 383):

“Clark should not get credit for originating the marginal productivity theory of distribution. Professor Stabile might have noted that said theory was developed by Henry George’s sometime disciple, Philip Wicksteed (1894), well before Clark (1899). The title of Wicksteed’s masterpiece, The Coordination of the Laws of Distribution, is obviously paraphrased from ‘The Correlation and Coordination of These Laws (of Distribution)’ (George, 1879, Book III, Chapter VII, 218). Wicksteed was formalizing, in more elegant form, an insight from his friend George.

“Wicksteed, unlike Clark, did that while retaining the identity of land as a distinctive factor of production. This could help explain why Clark failed to acknowledge Wicksteed. Clark may indeed have been ‘willing to adopt good ideas whatever their course,’ as Professor Stabile avers, but he was not always willing to give credit.”

The more I see of these comments the more I find that most of them are not based on scientific knowledge about how our social system works. My recent book available for free as an e-copy, is titled “Consequential Macroeconomics” and unlike the prior way this subject has been treated it is true science and not the pseudo-science mush which has been slopped up as fact! Write to me at chesterdh@hotmail.com and find out how an engineering approach to our society allows us to better understand it.

This article has some interesting arguments, although it does not explain neoclassical economics well enough to make a persuasive argument against the methodology it employs or the idea that it can or should be considered a ‘science.’ What can be considered a science, and why does it matter? What sort of influence does an idea have on economic policy decisions when it is considered a scientific idea? An article with a more thorough explanation of the historical development of neoclassical economic theory and how it’s ‘universal laws’ are actually historically contingent or based on assumptions that are outside the boundaries of reality, would be interesting. I think it would be even better to outline the counter arguments that could be made from the neoclassical perspective. I would tone down the anti-neoclassical rhetoric though. It’s difficult to take the author seriously when they are so clearly bias toward Marxism, or any other ideological perspective. Try to write from a more objective standpoint, even if you do have an axe to grind.

If you think for a moment that you can explain how our social system works without using a diagram and some simple maths, then you are still living in the past century, when people used intuition instead of logic to study this subject as if it were a pseudo-science.

Wake up to our century–the subject has now become a lot more scientific and many of the older writers are extinct in their imagined theories. Learn to construct the structure of our society by modeling it as simply but as comprehensively as possible through my SSRN 2865571 “Einstein’s Criterion Applied to Logical Macroeconomics Modeling” and begin to REALLY understand how it works as an almost exact science, even if my book is a bit too much for beginning this new way of thinking and better understanding.