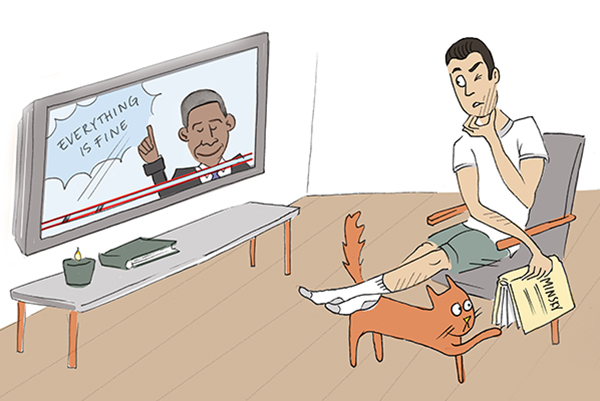

In a recent interview with Andrew Ross Sorkin, published in The New York Times, President Obama argued that the U.S. economy is in fine shape, despite public feelings that it might not be. Then a few days later the same newspaper ran an interview with William C. Dudley, the president of the Federal Reserve Bank of New York, in which he foresaw continued economic growth. And like the president of the Richmond Fed, Mr. Dudley made the case for slowly raising interest rates because the economy is “on track” and global conditions are “dramatically better.”

The rhetoric coming from these top policymakers can seem rather soothing to most people, including many economists. However, we know that Hyman Minsky would have remained highly skeptical. In fact, Minsky famously argued that “stability is destabilizing,” and that is because periods of economic instability and recessionary episodes emerge naturally out of the normal functioning of a prosperous modern capitalist economy.

For Minsky the nature of instability is linked to the relation between finance and investment in capital assets during the business cycle. Economic agents often compromise future incomes in order to secure the assets they need to undertake production. The accumulation of capital in the economy is largely financed by borrowing, which is recorded as liabilities on balance sheets. The liabilities represent a group of payment commitments on a future date, while the assets held represent a series of expected cash receipts from operations. The performance of the economy will later either validate or invalidate the structure of those balance sheets. Even though Minsky was talking about the capital development of the economy, his argument can be broadly extended to any economic unit; from a corporation borrowing to build its new headquarters to a person borrowing to buy a car or pay for college.

In his Financial Instability Hypothesis (FIH), Minsky identified the degree of financial fragility in the system by defining three income-debt relations for economic units: hedge, speculative, and Ponzi finance. For hedge financing units, the income flows from operations are enough to fulfill debt commitments outflows in every period. For units involved in speculative finance, the income flows are only enough to meet the interest component of their obligations and they will have to roll over debt because they cannot repay the principal. For Ponzi finance, the income flows from operations are not enough to cover the interest costs of their loans or the repayment of principal. Ponzi units highly depend on the possibility of refinancing their debt, otherwise they have to resort to the liquidation of assets or issuing new liabilities in order to meet their obligations.

The movement to more units engaged in Ponzi finance happens as a natural consequence of periods of stability and prosperity. During economic expansions, borrowers and lenders become confident in the ability of the former to meet cash commitments, which is a rational response based on recent past experiences and on the higher probabilities of success associated with the expansionary environment.

Thus, economic units are not likely to have difficulties to meet their payment commitments as they come due during economic expansions. However, such optimistic expectations lead to relaxing lending standards and reducing margins of safety. They also validate riskier projects, the use of more debt relative to assets, and lower liquidity; all of which increase the fragility of the economic system (for more see here and here).

Borrowers and lenders seem to operate on a hit-or-miss basis; if a behavior is successful, it will be rewarded and it will be repeated. So the behaviors described above will continue, and in fact be encouraged, until the turn of the economic cycle. Thus, while the economy prospers, financial positions are becoming increasingly fragile under the stable surface. Indeed, according to Minsky, during prolonged periods of prosperity the modern capitalist economy tends to move from a robust financial structure dominated by hedge financing units, to what he called a “deviation amplifying system” dominated by abundant speculative and Ponzi financing units.

The boom gives way to the bust when interest rates suddenly rise or when realized income flows fail to meet what was projected (note that economic units need not incur losses, but just have revenues depart from expectations – so basically any small shock to a fragile economy can potentially trigger a crisis). When the economic environment changes, income flows begin to fall and Ponzi units find it impossible to borrow to sustain their positions. They will then try to make position by selling out position; this means selling assets to meet their payments. The consequence of a generalized sell-off is to put downward pressure on asset prices, which can make the market prices too low as to generate sufficient income to meet the commitments – making this operation self-defeating. These dynamics, plus the excess supply, reinforce the necessity to sell and raise the real debt burden, leading to a potential Fisher-style debt deflation. These processes reset the system, starting again from a robust financial position – because all the fragile positions were washed off by the debt deflation – but will eventually give way to another crisis.

The idea that “stability is destabilizing” is summarized by Minsky’s two theorems of financial fragility in the FIH: (I) the economy has financing regimes under which it is stable (hedge) and financing regimes in which it is unstable (speculative and Ponzi); and (II) over periods of prolonged prosperity, the economy transitions from financial relations that make for a stable system to financial relations that make for an unstable system. In other words, the economy tends to move from a financial structure with abundant units engaged in hedge finance to a structure dominated by speculative and Ponzi units. The natural shift from hedge positions to speculative to Ponzi is a required condition for instability to arise, and, as explained above, the move (and the erosion of margins of safety) happens during periods of economic stability and prosperity. One of Minsky’s most important contributions was to point out that the process leading to an unstable system is an inevitable, endogenous, and evolutionary process of the modern capitalist economy.

So, what can we learn from all of this? Well, the next time you hear politicians or big shot economists talking about how stable the economy is and how on track it is, remember Minsky and remain skeptical.

Written by Oscar Valdes-Viera

In order for households to get enough deposits so they can pay back their debts, the government should run deficits that end up in their hands. The reliance on the private sector has taken priority over the public good, and most of the deposits have landed in the hands of the top 1%. They were supposed to “

In order for households to get enough deposits so they can pay back their debts, the government should run deficits that end up in their hands. The reliance on the private sector has taken priority over the public good, and most of the deposits have landed in the hands of the top 1%. They were supposed to “