French geopolitics in Africa is interested in natural resources. Initially, the franc zone was set as a colonial monetary system by issuing currency in the colonies because France wanted to avoid transporting cash. After these countries gained their independence, the monetary system continued its operation and went on to include two other countries that were not former French colonies. At present, the CFA franc zones are made up of 14 countries. The fact that even today the currency of these regions is pegged to the euro (formerly French franc) and that reserves are deposited in France shows the subtle neocolonialism France has been pursuing unchecked. It is a currency union where France is the center and has veto power. This is supported by African governing elites who rely on the economic, political, technical, and sometimes military support provided by France. It is no wonder then that these former colonies are not growing to their full potential because they have exchanged development through sovereignty for dependency on France. This article investigates the set up of the CFA franc zones, its ties to French neocolonialism and its ability to further breed dependency in the former colonies of West and Central Africa.

The CFA Franc Zones

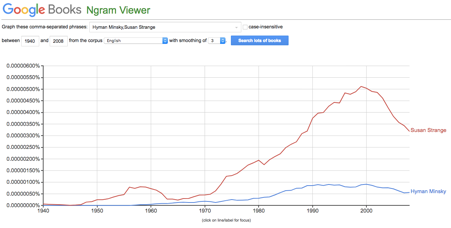

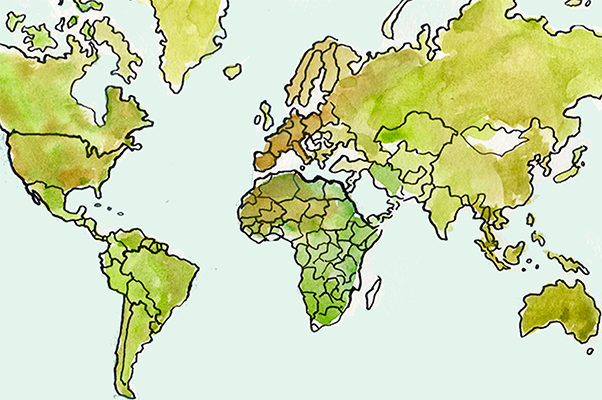

The first franc zone was set up in 1939 as a monetary region with a the French franc as its main currency. In 1945, the Franc des Colonies Francaises d’Afrique (CFA franc) and the Franc des Colonies Francaises du Pacifique (CFP franc) were created. After independence, Morocco, Tunisia, Algeria, and Guinea left. The Central African Economic and Monetary Union (CEMAC) and the West African Economic and Monetary Community (WAEMU) are known as the two CFA franc zones. WAEMU has eight members: Benin, Burkina Faso, Cote D’Ivoire, Guinea-Bissau (a former Portuguese colony joined in 1997), Mali, Niger, Senegal, and Togo. Their common currency is the “franc de la Communaute Financiere de l”Afrique (CFA franc), which is issued by the Central Bank of the West African States (BCEAO) located in Dakar, Senegal. CEMAC has six members: Cameroon, the Central African Republic, Chad, the Republic of Congo, Equatorial Guinea (a former Spanish colony joined in 1985) and Gabon. Their common currency is “franc de la Cooperation Financiere Africaine”, which is issued by the Bank of the Central African States (BEAC) located in Yaounde, Cameroon. It is worth mentioning that the BCEAO and the BEAC were headquartered in Paris until the late 1970s.

Since 1948, the two CFA francs were pegged at the rate of 50 CFA francs per French franc. In 1994, the CFA francs went through devaluation, 50 percent to be exact. At present, the arrangement of France to the two unions are a fixed peg to the euro, a convertibility guarantee by the French Treasury and lastly, a set of legal, institutional and policy requirements. The CFA franc zone links three currencies: the two unions and the euro. The CFA franc is fixed at 655.957 per euro. WAEMU and CEMAC each have their own central banks that are independent of each other. The CFA francs can be converted to the euro, but cannot directly be converted into each other. The money is sent to France as an operations account in the French Treasury by the two central banks. Furthermore, “at least 20 percent of sight liabilities of each central bank must be covered by foreign exchange reserves, at least 50 percent of foreign exchange reserves must be held in the operations account and increasing interest rate penalties apply if there is an overdraft. France is also represented on the board of both institutions.” In “Colonial Hangover: the Case of the CFA”, Pierre Canac and Rogelio Garcia-Contreras explain,

“The functioning of the Operations Accounts is critical to maintaining the convertibility of the CFA francs at the official exchange rate while, at the same time, allowing the regional central banks to maintain some monetary autonomy. The Operations Accounts are credited with the foreign reserves of the BCEAO and the BEAC, but can be negative when the balance of payments of the CFA zone members is unfavorable. When this is the case, the French treasury lends foreign reserves to the two central banks. This special relationship with the French treasury allows the two African central banks to maintain the fixity of the exchange rate while allowing them to have some limited control over their monetary policy. The amount of borrowing allowed is unlimited although subject to several constraints in order to limit the size of the debt. First, the central banks receive interest on their credit in the Operations Account, while they must pay a progressively increasing interest rate on their debit in the account. Second, foreign reserves other than French francs or euros may have to be surrendered – a practice called ‘ratissage’, or additional reserves may have to be borrowed from the IMF. Third, the French treasury appoints members to the boards of the BCEAO and BEAC in order to influence their respective monetary policies and to ensure their consistency with the fixed parity. The autonomy of both African central banks is curbed by the French authorities, thereby prolonging the colonial relationship between France and its former colonies.”

Apparently, representatives from France fill important positions in the Presidency, Ministry of Defense, Central Bank, Treasury, Accounting and Budget Departments, and Ministry of Finance, which allows them to have oversight and influence policy decisions. One French scholar observed that ministries from Francophone African states make around 2000 visits to Paris in an average year. Adom shows the money kept at the French treasury earns no or very low interest for the franc zone nations. In 2007, the former Senegalese President, Abdoulaye Wade had stated that the funds can be used to boost investment, economic growth and alleviate poverty in the member countries instead of sitting in France.

After the 1994 devaluation, the two CFA francs were pegged at the new rate of 100 CFA francs per French franc. The reason for the devaluation was accounted to loss of competitiveness as the French franc appreciated against the currency of major trading partners. These zones competitiveness was in the French market, but not to world markets. In the 1980s, there was a fall in the price of raw materials and a depreciation of the dollar. As a result, the growth and export of these nations were impacted. The governments of these zones were facing budget deficits, which they financed by borrowing from abroad until the IMF refused to lend them any more money in 1993. As for trade between the unions, it is low due to an external tariff. Capital flows between these unions is highly restricted. The hope that a monetary union would increase trade among the CFA franc zones never materialized.

Neocolonialism and France

Kwame Nkrumah stated, “…imperialism… claims, that it is “giving” independence to its former subjects, to be followed by “aid” for their development. Under cover of such phrases, however, it devises innumerable ways to accomplish objectives formerly achieved by naked colonialism. It is this sum total of these modern attempts to perpetuate colonialism while at the same time talking about “freedom”, which has come to be known as neo-colonialism.”

In “Government accounting reform in an ex-French African colony: The political economy of neocolonialism”, P.J.C. Lassou and T. Hopper state, “colonialism does not cease with the declaration of political independence or the lowering of the last European flag. Decolonization is a formal facade if former colonies cannot acquire the socio-economic base and political institutions to manage themselves as sovereign independent countries. The modern manifestation of colonial and imperialist traits is commonly labeled neocolonialism, which is sometimes linked to ‘dependency’. Neocolonialism occurs when the former colonial power still controls the political and economic institutions of former colonies.”

France is carrying out neocolonialism by disguising this arrangement as a monetary union. These nations gave up their sovereign right to France. Neocolonialism is an impediment to development within African nations. France’s intervention was carried out through economic, political and militaristic ways. The ‘Accords de Cooperation’ was signed by African leaders who gained power with France’s help at independence. On the other hand, the ‘Accords speciaux de defence’ provided France power to intervene militarily to protect African leaders who protected France’s interests. Lastly, the economic accords require former colonies to export their raw materials such as oil, uranium, phosphate, cocoa, coffee, rubber, cotton … etc to France while importing industrial goods and services primary from France. Furthermore, these nations reduce or ban their raw material exports when French defense interest require.

Lassou and Hopper stress that accounting is a neglected part of development policies, especially in Francophone Africa. They share that “market-based reforms when applied in the South generally and Africa specifically…promote neocolonialism, enabling former colonial powers to retain control over political and economic institutions of former colonies to the advantage of multi-national corporations and trade whereby ‘Southern’ countries export cheap raw materials to ‘Northern’ countries and import high value-added goods and services in return.”

According to the Human Development Index, out of 187 countries, the last three and seven of the worst ten countries are from Francophone Africa. France’s neocolonialism approach is extremely subtle and paternalistic. The former French President, Jacques Chirac, said, “ We forget one thing: that is, a large part of the money that is in our [I.e., the French’s] wallet comes precisely from the exploitation of Africa [mostly Francophone Africa] over centuries.” In 2008, he went on to say, “without Africa France would slide down into the rank of a [third] world power.”

Dependency Theory and Francophone Africa

Africa, Asia, and Latin America have pursued sustainable development since gaining independence. However, a few countries succeeded in actually developing their economies. In the 1950s, Raul Prebisch and other economist came up with the dependency theory, which explains why “economic growth in the advanced industrialized countries did not necessarily lead to growth in poorer countries.” Prebisch suggested that poor countries (periphery nations) exported raw materials to the developed countries (center nations) and imported finished goods. Moreover, there is a dynamic relationship between dominant and dependent states. Andre Gunder Frank claimed that the capitalist world system was divided into two concentric spheres: center and periphery. The advanced center countries need cheap raw materials from the underdeveloped periphery as well as a market to send their finished products.

It has been decades since African countries gained independence. However, this independence was replaced by a dominance-dependence relationship known as post-colonialism. A dominance-dependence occurs “when one country is able to participate in a definitive or determining way in the decision-making process of another country while the second country is unable to have the same participation in the decision-making of the first country.” Furthermore, the foreign and domestic policies of the independent African nations continue to be influenced by outside powers, especially their former colonizers. The post-colonial relationship when it came to former French colonies is the dominant role held by France.

French colonialism was one of state colonialism. It was one of direct rule where native chiefs assisted French administrators, which led to the rise of local elites who were educated in the French system. The former colonies were indoctrinated with French culture, language, and law. In the time of independence, sub-Saharan colonies decolonized in a non-violent way while former British colonies gained their independence through war, a violent way that loosened the relationship towards Great Britain. Because freedom from France was carried out through non-violence, it came naturally for local elites to take power and continue their strong ties with France.

Through the CFA franc zone, France is able to control the money supply, monetary and financial regulations, banking activities, credit allocation, and budgetary and economic policies of these nations. In addition, it breeds corruption and illegal diversion of public aid between France and its former colonies. For instance, conditional French public aid has forced these African states to spend the ‘aid’ money on French equipment, goods or contracts with French firms, especially construction and public work firms.

S.K.B. Asante points out that regional integration approaches do not remove the neocolonialism and dependency the African continent faces. He states, “none of the regional schemes have adequate provisions for attacking the all-embracing issue of dependency reduction nor have the efforts made towards this objective had any significant impact…the problem of dependency poses difficulties for African countries attempting a strategy of regional integration. Dependency serves as an obstacle to de-development it not only limits the beneficial effects of integration in both national and regional economy.”

Economic Performance of the CFA Franc Zones

France is the main trading partner of the CFA franc zones. CFA franc zones, unlike other African nations, have avoided high inflations due to France. The two zones between 1989 and 1999 had 33 percent of imports and 40 percent of Foreign Direct Investment from France. These regions are highly dependent on France. Despite their ties to France, these CFA franc zones remain extremely poor. The two regions had a population of 132 million in 2008 where 70 percent are in WAEMU and 30 percent are in CAEMC. Their total GDP is equal to 4 percent of the French GDP. These regions are “producers and exporters of raw materials, including oil, minerals, wood and agricultural commodities, and agricultural commodities, they are highly sensitive to world price fluctuations and the trade policies of their trading partners, mainly the EU and the US. Their industrial sectors are rather underdeveloped.” Non-oil producing nations within the CFA franc zones have very low GDP per capita.

According to Assande Des’ Adom, even after the currency was devalued, the CFA franc zones still suffer from currency misalignments. Adom points out, “the current monetary arrangements between the former colonies and France were designed based essentially on the economic interest of the latter. A prominent Ivorian economist goes even further to explain how franc zone’s member countries indirectly finance the French economy through these peculiar monetary arrangements.”

The CFA franc zone is challenged by globalization, volatile oil and raw material prices in addition to regional security problems. It can be argued that the “dependency and neocolonial practices surrounding the relationship between France and former colonial possessions in Africa is the inability of CFA countries to build up monetary reserves.” In today’s world, control of a country is carried out through economic and monetary ways. Nkrumah had warned

“The neocolonial state may be obliged to take the manufactured products of the imperialist power to the exclusion of competing products elsewhere. Control over government policy in the neo-colonial state may be secured by payment towards the cost of running the State, by the provision of civil servants in positions where they can dictate policy, and by monetary control over foreign exchange through the imposition of a banking system controlled by the imperial power.”

In conclusion, the CFA franc zones continue to be dominated by the political will, economic interest, and geopolitical strategy pursued by the French republic. It seems some elite leaders do not wean away from France’s influence. President Omar Bongo of Gabor said, “France without Gabon is like a car without petrol, Gabon without France is analogous to a car without a driver.” The previous quote can be applied to almost all of the franc zone nations. The set up of the currency unions benefits France more than its members. French colonialism is preventing the development of these nations and causing them to be dependent.